Construction firm ISG has filed for administration in what could be the biggest collapse of a UK construction company since Carillion.

Email ECA's Legal and Business team: legal@eca.co.uk

ECA’s Business Policy & Practice Guidance on Insolvency risk mitigation can be found here.

ECA Director of Legal and Business Rob Driscoll shares his advice to ECA Members who may be exposed to risk following this news:

Another giant of construction falls to the tsunami of insolvencies.

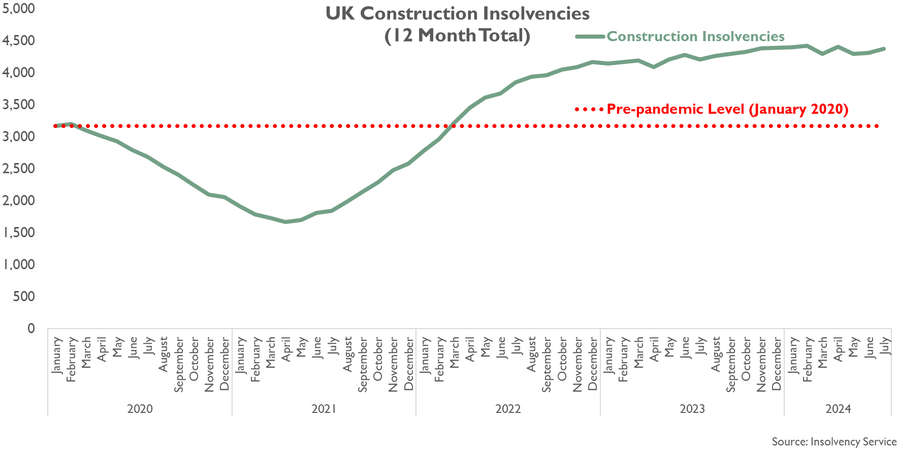

Thanks to CPA data - pictured below - 4,373 construction firms went out of business in the UK in the year to July 2024, which is 4.0% higher than a year earlier.

ECA understands that:

ECA understands that:

- ISG Construction Limited,

- ISG Engineering Services Limited,

- ISG Retail Limited,

- ISG Jackson Limited and

- ISG Central Services Limited

have filed for administration.

If another part of ISG is not in administration, ECA Members may wish to take evasive action to curb their exposure. The parent company, ISG Limited, has, so far, not applied to the court for insolvency of any kind.

Immediate action should include:

- If you are able to access site, use photographic, video and written records of your work in progress.

- Ensure records are up to date.

- If you have access to sites, recover plant, tools and unfixed materials which you have title to and have not yet been paid for.

- Maintain contact with ISG representatives.

- Establish contact and claim for unpaid works with the appointed administrator.

Records will be invaluable in establishing the value of your “final account” and can be used for any negotiations with any main contractor who is brought in to complete the contract.

Administration is not liquidation

The situation is not yet terminal. Existing contracts may have termination on insolvency provisions or may simply give the right for you to choose to terminate on ISG’s insolvency following a prescriptive procedure.

You do not yet know if the end-client will terminate or allow these entities to continue to deliver under the administration process. In which case, the administrators may attempt to offer sub-contractors an opportunity to complete.

Consider if you have the right to terminate

Consider any obligations you may have under novation clauses or collateral warranty step-in clauses to continue working for new main contractors and refresh yourself on the issue of if those obligations are subject to you getting paid what you are owed.

You should prepare a schedule that shows a record of all outstanding payments including retentions and when these payments were due, if they are unpaid.

For materials that are required for the contract but have not been delivered to the site then make careful note of these and further advice will be provided in due course as matters unfold. You should avoid at all costs any damage to your completed works.

If offers come in to complete the works under new contracts, check they are not more onerous than your existing contracts and negotiate to recover some of the losses within the price to complete.

Do due diligence on new parties and seek to improve your cash-flow exposure

- Shorter; application, due date, final date, payment cycles.

- Advanced payment for materials.

- Performance bond from any party who is not financially robust enough and seeks to step into ISG’s shoes and engage you.

- No retentions.

There is value to the end-client in completing with the original sub-contractors in order to maintain an uninterrupted duty of care, warranty and insurance, even if the client has to pay a premium for the privilege and there is commercial value in keeping resources engaged provided you are able to get paid.

Email us: legal@eca.co.uk

Stay safe and resilient!

ECA’s Business Policy & Practice Guidance on Insolvency risk mitigation can be found here.

Last updated 20 September 24